What amount is considered substantial under E2 Visa Requirements

Wiki Article

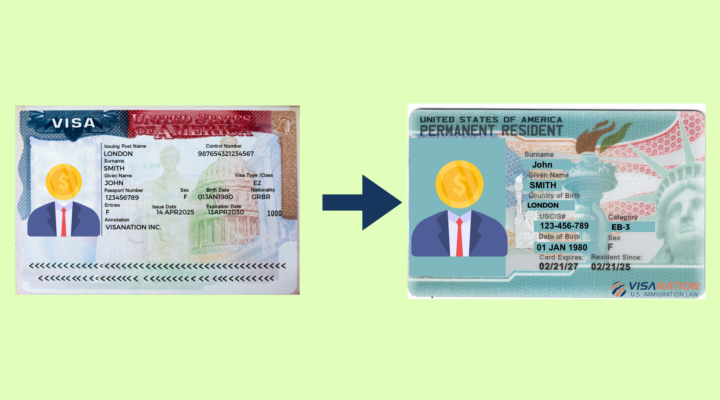

Your Path to the U.S.: Understanding E2 Visa Financial Investment Requirements and Benefits

The E2 Visa works as a feasible avenue for foreign capitalists looking for to develop a footing in the united state economy through service ventures. Understanding the financial investment requirements and eligibility criteria is essential for those considering this course, as it involves specific economic dedications and functional mandates. Additionally, the advantages connected with this visa can greatly enhance one's business leads in the USA. Yet, many potential financiers stay unclear regarding the subtleties of the application process and the kinds of financial investments that qualify. Discovering these components can give beneficial understandings for prospective applicants.What Is the E2 Visa?

The E2 visa is a non-immigrant classification that permits international nationals from treaty nations to go into the United States to spend in and manage a company. This visa is particularly developed for people that seek to add capital to a united state business, thus promoting financial growth and producing job opportunities. The E2 visa is especially appealing because of its adaptability and the possibility for revival, as long as the business stays functional and fulfills the needed requirements.To get the E2 visa, candidates have to show a substantial investment in a bona fide business. This financial investment needs to be adequate to ensure the business's feasibility and success. The E2 visa can be released for an initial period of approximately 2 years, with the possibility of extensions in increments of two years, permitting investors to preserve their standing as long as they satisfy the conditions of their financial investment and business procedures.

Along with the investment facet, the E2 visa enables for the inclusion of member of the family, including children and partners, who can go along with the major investor to the United States. This element boosts the advantages of the E2 visa as a pathway for individuals looking for to establish roots in the united state via business endeavors.

Qualification Criteria

To get an E2 visa, investors should meet certain standards that include numerous aspects of their service endeavors. This consists of an evaluation of the investor's certifications, the nature of the organization they plan to operate, and the called for investment amount. Understanding these aspects is crucial for prospective applicants aiming to protect this visa effectively.Capitalist Certifications Summary

Numerous individuals looking for E2 visa status have to fulfill particular eligibility standards to certify as investors. Mainly, applicants have to be nationals of a nation that has a treaty of commerce and navigating with the United States. This demand warranties alignment with U.S. diplomacy and economic passions.One more essential standard is the financial investment amount, which should be substantial adequate to establish and run a sensible company. While no fixed minimum financial investment is specified, quantities commonly range from $100,000 to $200,000, depending upon the nature of the venture. The financial investment ought to show a commitment of funding, risk of loss, and capacity for productivity.

The investor must hold at least 50% ownership of the service or have operational control with other ways, such as a supervisory placement. It is additionally vital that business is not low; it must generate more than adequate income to sustain the financier and their household.

The candidate needs to show that the funds being spent are gotten with authorized methods, assuring conformity with U.S. lawful standards. Meeting these credentials is important for an effective E2 visa.

Organization Kind Factors To Consider

Picking the proper company kind is a crucial consider conference E2 visa eligibility criteria. The E2 visa is specifically developed for financiers that desire to create and direct the procedures of a company in the United States. USA Visa E2. To qualify, the service must be a bona fide business, which usually indicates it should be a genuine, energetic business undertaking producing goods or services commercialCertain kinds of services are a lot more favorable for E2 visa applicants. Usually, service-based companies, retail operations, and certain manufacturing endeavors are taken into consideration eligible. The company must ideally demonstrate prospective for growth and work production, which can enhance the investor's application. Additionally, passive financial investments, such as property or supply investments, do not get approved for E2 standing, as they fail to satisfy the demand for energetic interaction in business.

Additionally, business needs to be structured as a lawful entity in the U. American E2 Visa.S., such as a firm or limited obligation firm (LLC) This legal structure not just supplies liability protection but likewise develops the authenticity of the financial investment, thus meeting a key requirement for E2 visa qualification. Selecting the right company kind is subsequently important for an effective application

Financial Investment Quantity Demands

The financial investment quantity is a crucial part of the E2 visa eligibility requirements, as it directly influences a candidate's capacity to develop a sensible service in the United States. While the U.S. government does not define a minimal investment amount, the demand generally determines that the financial investment has to be significant in regard to the total expense of acquiring or establishing business.Commonly, investments varying from $100,000 to $200,000 are typical, although lower quantities might serve depending on the nature and practicality of the enterprise. The funds have to be at threat, implying they must be irrevocably dedicated to the business and not simply held as collateral or in book.

The financial investment must be adequate to assure the company's success and be qualified of producing enough income to support the financier and their household. The type of organization can additionally influence the financial investment demand; for instance, a startup might call for a various amount than a franchise business or an existing organization procurement. Inevitably, candidates should show that their investment suffices to develop a sustainable business, straightening with the E2 visa's intent to promote financial development in the USA.

Investment Quantity Needs

When thinking about the E2 visa, understanding the investment quantity demands is essential. Candidates need to meet a minimal financial investment limit, which varies depending on the nature of business. In addition, it is very important to supply clear documents pertaining to the source of funds to guarantee compliance with united state immigration guidelines.Minimum Investment Threshold

For those thinking about the E2 visa, comprehending the minimum investment threshold is vital to ensuring compliance with U.S. immigration laws. The E2 visa does not state a certain dollar quantity for the investment; nonetheless, the investment should be significant in connection with the price of business. Generally, a minimum financial investment of $100,000 is frequently mentioned as a standard, especially for services in affordable industries.The main factor to consider is that the financial investment must be enough to develop and operate a feasible business. This suggests the funds need to be at risk and dedicated to the organization, showing the capitalist's purpose to proactively develop the business and manage. Furthermore, the financial investment needs to provide a substantial payment to the U.S. economic climate, often assessed by the work creation potential for U.S. employees.

Financiers ought to additionally realize that reduced financial investment quantities may serve for sure organizations, specifically those in much less capital-intensive fields (Treaty Countries). Ultimately, the details financial investment quantity will certainly rely on the nature of business and its functional requirements, strengthening the importance of thorough planning and economic evaluation prior to application

Source of Funds

Developing the source of funds for an E2 visa investment is a crucial aspect of the application process, as it guarantees that the financial investment is traceable and legit. United state migration authorities call for applicants to show that the funds utilized for the financial investment have actually been obtained with legal means, guaranteeing compliance with anti-money laundering guidelines.To please this requirement, applicants must provide thorough paperwork that plainly highlights the origin of their investment funding. This may include financial institution declarations, tax returns, pay stubs, or sales agreements, reflecting the accumulation of funds in time. It is important to provide a clear financial history, outlining exactly how the funds were obtained, whether through individual financial savings, business revenues, or financings from acknowledged economic establishments.

Additionally, applicants need to be prepared to resolve any possible warnings, such as unexpected increases of large amounts, which may increase uncertainties. A well-documented resource of funds not only strengthens the E2 visa but also enhances the candidate's reliability. Inevitably, guaranteeing the legitimacy of the investment is vital for an effective change to developing a company in the United States.

Sorts Of Qualifying Investments

Qualifying financial investments for the E2 Visa can take numerous kinds, each customized to fulfill particular standards set by the U.S. government. The main requirement is that the financial investment should be adequate and substantial to ensure the successful operation of business. This often entails a minimum investment limit, generally beginning around $100,000, however the exact quantity can vary based on the nature of the organization.One common form of qualifying investment consists of the acquisition of an existing business, where the financier takes and obtains functional possessions over administration. Alternatively, starting a brand-new organization can also qualify, supplied that business strategy shows viability and capacity for development.

Furthermore, investments in tangible properties like devices, stock, or genuine estate utilized in business are identified as certifying investments. Totally passive financial investments, such as buying stocks or bonds, do not satisfy E2 Visa requirements. The financial investment needs to be at risk and actively included in business procedure, guaranteeing that the capitalist plays a crucial duty in its success. Understanding these investment types is important for possible E2 Visa applicants to navigate the procedure successfully.

Organization Possession and Control

The candidate should have the capacity to create and direct the business's procedures. This indicates that they must hold an exec or managerial placement, permitting them to influence the daily service choices. If the organization is a company or a collaboration, the financier should additionally be actively entailed in its administration, showcasing their commitment and beneficial interest in the success of the endeavor.

Paperwork is vital in establishing ownership and control. This often consists of business charts, operating arrangements, and records that information the investor's role and payments. Clear evidence of control enhances the E2 copyright, as it emphasizes the capitalist's energetic participation, thereby aligning with the visa's intent to advertise economic growth and job production in the U.S.

Benefits of the E2 Visa

The E2 Visa offers an array of advantages that make it an appealing choice for foreign investors seeking to manage a business or develop in the USA. One of the key advantages is the capability to live and function in the U.S. while proactively handling the investment. This visa enables a versatile duration of remain, as it can be renewed forever, provided business remains functional and satisfies the visa demands.In Addition, E2 Visa holders can include their immediate family members, enabling spouses to function and kids to participate in college in the U.S. This produces a helpful environment for family members moving for organization purposes. One more considerable benefit is the fairly low financial investment limit contrasted to other visa categories, enabling a broader variety of capitalists to qualify.

The E2 Visa also gives access to a diverse and robust market, giving chances for networking and company development. Unlike various other visa kinds, there are no yearly caps on E2 visas, which suggests that candidates might face less competitors. Overall, the E2 Visa presents a sensible path for international entrepreneurs wanting to increase their organization horizons in the United States.

Application Process Introduction

Steering the application process for the E2 Visa calls for mindful prep work and interest to information. The very first step is to evaluate eligibility, making sure that you are a nationwide of a treaty nation and possess the requisite investment quantity in a qualified enterprise. Following this, candidates need to create an extensive company strategy that lays out the operational and economic aspects of the suggested venture, demonstrating its viability and possibility for development.As soon as the service strategy is settled, the next step is to collect essential documentation. This includes proof of financial investment funds, proof of ownership, and detailed financial projections. It's necessary to compile all relevant documents diligently, as any type of disparities can bring about denials or delays.

After organizing the documentation, candidates must complete the DS-160 type and pay the visa cost. Ultimately, a consular meeting should be set up, where the candidate will certainly present their case and supporting materials to a consular officer.

Often Asked Concerns

Can I Get an E2 Visa With a Partner?

Yes, you can obtain an E2 visa with a companion. Both people need to fulfill qualification requirements, and the investment has to be considerable. Joint possession or partnership in the investment venture is permissible under E2 visa laws.The length of time Is the E2 Visa Valid For?

The E2 visa is originally valid for as much as 2 years. It can be restored forever, provided the business remains operational and meets the visa demands, permitting for recurring financial investment and continued residency in the U.S.Can I Work Outside Function Outdoors on service E2 Visa?

An E2 visa mainly allows the holder to work within their own investment enterprise. Participating in employment outside business is normally not allowed unless particularly accredited, as it may threaten the visa's legitimacy.Is There an Age Limit for E2 Visa Applicants?

There is no certain age limit for E2 visa candidates. Nonetheless, people should demonstrate their financial investment abilities and meet various other qualification requirements, including being a nationwide of a qualifying treaty nation to safeguard the American E2 Visa visa.Can Kid of E2 Visa Holders Attend Institution in the united state?

Yes, kids of E2 visa holders can go to institution in the United States. They are qualified for public education, permitting them to gain from the academic possibilities offered to homeowners, fostering their development and assimilation.In enhancement to the investment element, the E2 visa allows for the incorporation of family members, consisting of spouses and children, who can go along with the primary investor to the United States. The financial investment quantity is a critical component of the E2 visa qualification criteria, as it directly impacts an applicant's capability to develop a practical company in the United States. The E2 visa does not specify a details buck amount for the investment; nevertheless, the financial investment needs to be significant in relationship to the price of the service. Developing the resource of funds for an E2 visa investment is an essential facet of the application procedure, as it ensures that the financial investment is legitimate and traceable. In addition, financial investments in substantial possessions like devices, supply, or real estate utilized in the organization are acknowledged as qualifying financial investments.

Report this wiki page